maryland earned income tax credit stimulus

Maryland Governor Larry Hogan has now signed a bipartisan stimulus bill worth 12 billion called the RELIEF Act. DIRECT STIMULUS PAYMENTS FOR LOW TO MODERATE-INCOME MARYLANDERS This relief begins with immediate payments of 500 for families and 300 for individuals who filed for the Earned Income Tax Credit.

Relief Act Of 2021 Tax Stimulus Relief Bethesda Cpa Firm

Maryland passed a sweeping state stimulus package of roughly 12 billion on Friday including an.

. The state EITC reduces the amount of Maryland tax you owe. It would provide the third round of stimulus checks after the 200 payments last March and the 0 First round of. Marylanders would qualify for these payments who annually earn.

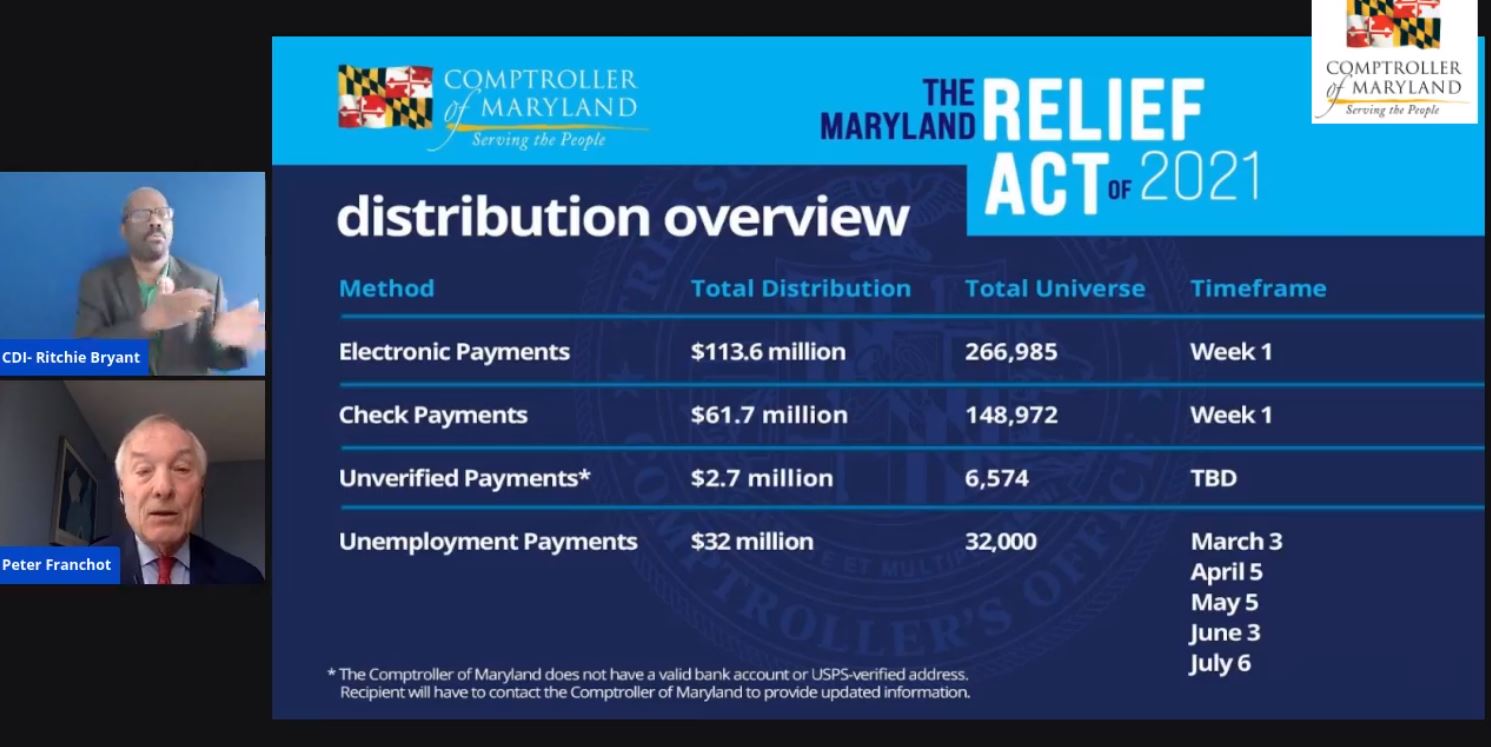

Hogan Jrs R billion-dollar relief package relied on the Earned Income Tax Credit EITC to provide direct stimulus payments for low-income Marylanders hit hard by the pandemic. The RELIEF Act of 2021 as enacted by the Maryland General Assembly and signed into law by the Governor provides direct stimulus payments to qualifying Marylanders unemployment insurance grants to qualifying Marylanders and grants and loans to qualifying small businesses. The earned income tax credit exists to help middle- to low-income individuals and families reduce the amount of taxes they pay and can.

You could argue those folks may be even. Residents of maryland who have filed their 2019 maryland state tax return. If you are a part-year resident or a member of the military see Instruction 26o before completing this worksheet.

See Worksheet 18A1 to calculate any refundable earned income tax credit. Heres all you need to know. To be eligible for.

This form shows the income you earned for the year and the taxes withheld from those earnings. Paper checks are being mailed by the last three digits of your zip code and will continue to be sent through january 11 2022. Under the bipartisan Relief Act of 2021 stimulus payments of 300 and 500 went out to Marylanders who received the earned income tax credit on their 2019 state tax return.

The Maryland stimulus money would be in addition to federal stimulus checks. Some taxpayers may even qualify for a refundable Maryland EITC. The stimulus package nearly doubles the lump-sum payments to poor individuals and working families who qualify for the earned-income credit which last year went to 440000 of the states 32.

The federal relief will provide 600 stimulus checks and 300 per week in supplemental unemployment benefits. Maryland approves coronavirus relief bill that would greatly expand Earned Income Tax Credit. Taxpayers without a qualifying child may claim 100 of the federal earned income credit or 530 whichever is less.

If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. An expansion of Marylands Earned Income Tax Credit passed quietly into law when Gov. The Maryland earned income tax credit EITC will either reduce or.

Governor of Maryland Larry Hogan has now signed a bipartisan stimulus bill worth 12 billion called the RELIEF Act. Provides direct stimulus payments for low-to-moderate income Marylanders with benefits of up to 750 for families and 450 for individuals. To qualify for a stimulus payment you must have a valid Social Security number and received the Maryland Earned Income Credit EIC on your 2019 Maryland state tax return.

To qualify for a stimulus payment you must have a valid social security number and received the maryland earned income credit eic on your 2019 maryland state tax return. Maryland will send 500 stimulus payments to families and 300 for individual taxpayers who filed for the earned income tax credit within the. Answer a few quick questions about yourself to see if you qualify.

Additional Child Tax Credit. The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income. 2021 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked.

That group of taxpayers which. This relief begins with immediate payments of 500 for families and 300 for individuals who filed for the Earned Income Tax Credit followed by a second-round stimulus for EITC filers that would provide an additional 250 for. The earned income tax credit eitc is a benefit for working people with low to moderate income.

Thelocal EITC reduces the amount of county tax you owe. Select the tax year you would like to check your EITC eligibility for. Larry Hogan called his top legislative priority.

Your earned income must be more than 2500 for 2019. All fields are required. Similar to federal stimulus payments no application for relief is necessary.

But since taxpayers need a Social Security number to qualify for the EITC thousands of immigrants wouldnt see any of that relief advocates said. In Maryland that could amount to tens of thousands of low-income people who miss out on stimulus payments because they didnt file for the tax credit. Individuals and families with children can get a 1400 check under the program.

In Maryland anyone who filed for Earned Income Tax Credit on their 2019 taxes can get stimulus checks worth 0 families or 0 individuals. Senate Bill 218 extends the tax credit to people who pay taxes using Individual Taxpayer Identification Numbers ITINs for the 2020 2021 and 2022 tax years. The tax credit got a big boost last month after lawmakers approved the RELIEF Act the 12 billion state stimulus package that Gov.

This webpage provides information on payment eligibility and additional. R allowed the bill to take effect without his signature. Find out whats in it.

For wages and other income earned in.

Maryland State Stimulus Checks Turbotax Tax Tips Videos

How Do State And Local Individual Income Taxes Work Tax Policy Center

Md Check When 3rd Coronavirus Stimulus Payment Arrives Baltimore Md Patch

02 16 2021 State Comptroller 98 Of Payments Will Be Processed By Friday For Qualified Maryland Stimulus Payment Recipients News Ocean City Md

New 2022 Maryland Tax Relief Legislation Passed Sc H Group

Irs Child Tax Credit Payments Start July 15

My Family Received A 500 Stimulus Check From This State And Yours Can Too Here S How

Here S Who Gets A Check Or Tax Break Under The Relief Act And When You Will Be Paid

Maryland Relief Act What You Need To Know Mvls

Maryland Stimulus Check How Will I Get The Money Cash Credit Card Or Bank Transfer As Usa

How To Get 1 000 Stimulus Checks If You Live In These States

Marylanders Who Qualify For The Relief Act Could Start Receiving Stimulus Checks This Week

Maryland Refundwhere S My Refund Maryland H R Block

Franchot Urges Md Lawmakers To Ok 2 000 Survival Checks Wbff

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

Relief Act Of 2021 Tax Stimulus Relief Bethesda Cpa Firm

Stimulus Checks Some States Are Issuing Checks And Bonuses To Millions Of Residents Cbs News